The United States COBRA Act ensures that workers have the right to continue their health insurance coverage if their group medical plan would end due to loss of employment or reduction in hours. Long-Term Coverage is Available.

Cobra Faq Colorado Health Agents

COBRA coverage allows qualified beneficiaries the right to maintain group health benefits when coverage would otherwise be lost due to a qualifying event.

. COBRA Rates FY 2022-23 For questions related to enrollment or payment contact the COBRA Third-Party Administrator TPA at. If you have questions about choosing COBRA please call our HealthCaregov Certified Insurance Specialists. Its available if youre already enrolled in an employer-sponsored medical dental or vision plan and your company has 20 or more employees.

The COBRA Insurance website helps workers with their insurance options while in-between employers. Colorado has a similar law that covers more employers but offers less protection. Emergency Regulation 21-E-15 Concerning Suspension of Utilization Review Requirements for Transfers or Discharges from Hospitals Experiencing COVID-19-Related Clinical Staffing Shortages - effective 11521.

You can remain insured and have health coverage for new illnesses or injuries with Short-Term Medical Insurance. COBRA Insurance in Colorado. 4-1 Life Insurance 4-2 Accident and Health General 4-3.

The federal Consolidated Omnibus Budget Reconciliation Act COBRA. Some states have similar insurance continuation laws. However the plan may require you to pay the entire group rate premium out of pocket plus a 2 administrative fee so cost is an important.

While COBRA is temporary in most circumstances you can stay on COBRA for 18 to 36 months. This is when the federal government created the law called Consolidated Omnibus Budget Reconciliation Act COBRA. Regulations are listed in the table below categorized using the following section headings.

Emergency Regulation 21-E-16 Concerning Colorado Option Standardized Health Benefit Plan - effective 12121. To help you maintain compliance here is a quick primer. There are three elements to qualifying for COBRA benefits.

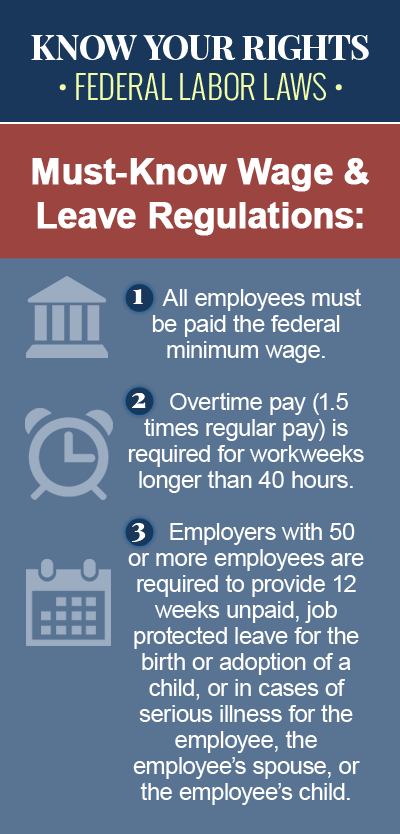

Federal COBRA says an employer who offers group health benefits and has 20 or more employees for at least 50 percent of its typical business days during the preceding calendar year must. By - September 12 2021. If you work for a company with 20 or more employees and if you were covered under an Employer Sponsored Group Health Insurance plan then you generally become eligible for COBRA benefits.

3-1 Financial Issues General 3-2 Securities 3-3 Reinsurance 3-4 Holding Companies 3-5 Title Insurance. Coverage is available up to 1 million per person. Federal cobra says an employer who offers group health benefits and has 20 or more employees for at least 50 percent of its typical business days during the preceding calendar year must comply with federal cobra laws.

Generally making the determination to comply with Federal COBRA or Colorado Continuation Coverage Laws is based upon the number of employees for a business. Qualifying events are events that trigger the loss of insurance benefits through your employer such as termination of employment reduced working hours or dependent children. This law requires employers with 20 or more workers to notify former employees within 45 days of their right to elect or waive.

This can protect you from high medical costs of new injuries or new illnesses that unexpectedly occur while allowing you to use any licensed doctor. Colorado COBRA Health Insurance Continuation federal national and state compliance resources - regulations laws and state-specific analysis for employers and HR professionals. A better option for many healthier people is to enroll in individual medical or short term medical plans.

Your COBRA coverage will become effective once your first premium is received by the COBRA TPA. Lets also take a look at other specific mini-COBRA laws by state. The Consolidated Omnibus Budget Reconciliation Act of 1985 also known as COBRA is a federal law requiring private businesses with 20 or more employees to provide their workers and qualified beneficiaries the option to continue their group health benefits if those benefits were to end.

Cobra health insurance colorado coverage can be split up to cover only the primary insured. The federal Consolidated Omnibus Budget Reconciliation Act COBRA gives employees the right to continue their group health insurance coverage if they leave the group for certain specified reasons. COBRA establishes specific criteria for plans qualified beneficiaries and qualifying events.

Coverage is retroactive once payment is received. Alternatives to cobra insurance in colorado self employed the best short term health insurance plans in 5 min. We also provide an alternative to COBRA if it is unavailable or you simply can not afford it.

In some cases you can continue coverage for an additional 11 months beyond the maximum normally allowed if youre disabled at a cost of 150 of the premium for each additional month. This coverage period provides flexibility to find other health insurance options. Amnesia by Grace Carter Favorite celebrities New music.

For more information and pricing you can call us at 1-877-262-7241 or complete a free quote online. Cobra Insurance Rules Colorado. Your spousepartner and dependents can also be included on your COBRA coverage.

Plan Coverage Group health plans for employers with 20 or more employees on more than 50 percent of its typical business days in the previous calendar year are subject to COBRA. With the economy being what it is here in Colorado we are fielding plenty of calls from people who have just been laid off. 2021 Emergency Regulations.

People aged 40-45 may want to look at higher deductible HSA. The law allows people to keep their health insurance between jobs. COBRA is a federal law passed three decades ago to give families an insurance safety net between jobs.

Colorado COBRA Health Insurance Continuation. Many 30-35 year olds can obtain single person coverage for as low as 87 per month or 277 per month for family on a plan with a 3500 deductible and a two-year rate guarantee. COBRA The Basics.

Prior to 1985 when someone lost their job or had their hours cut it could lead to them losing their health insurance. 1-1 Administrative Procedures 1-2 Licensing Requirements and Rules for Producers. What you need to know.

Complete Guide To Auto Insurance Laws In Colorado

Colorado Cobra Continuation Coverage Law Help

Key Design Components And Considerations For Establishing A Single Payer Health Care System Congressional Healthcare System Medicare Advantage Health Policy

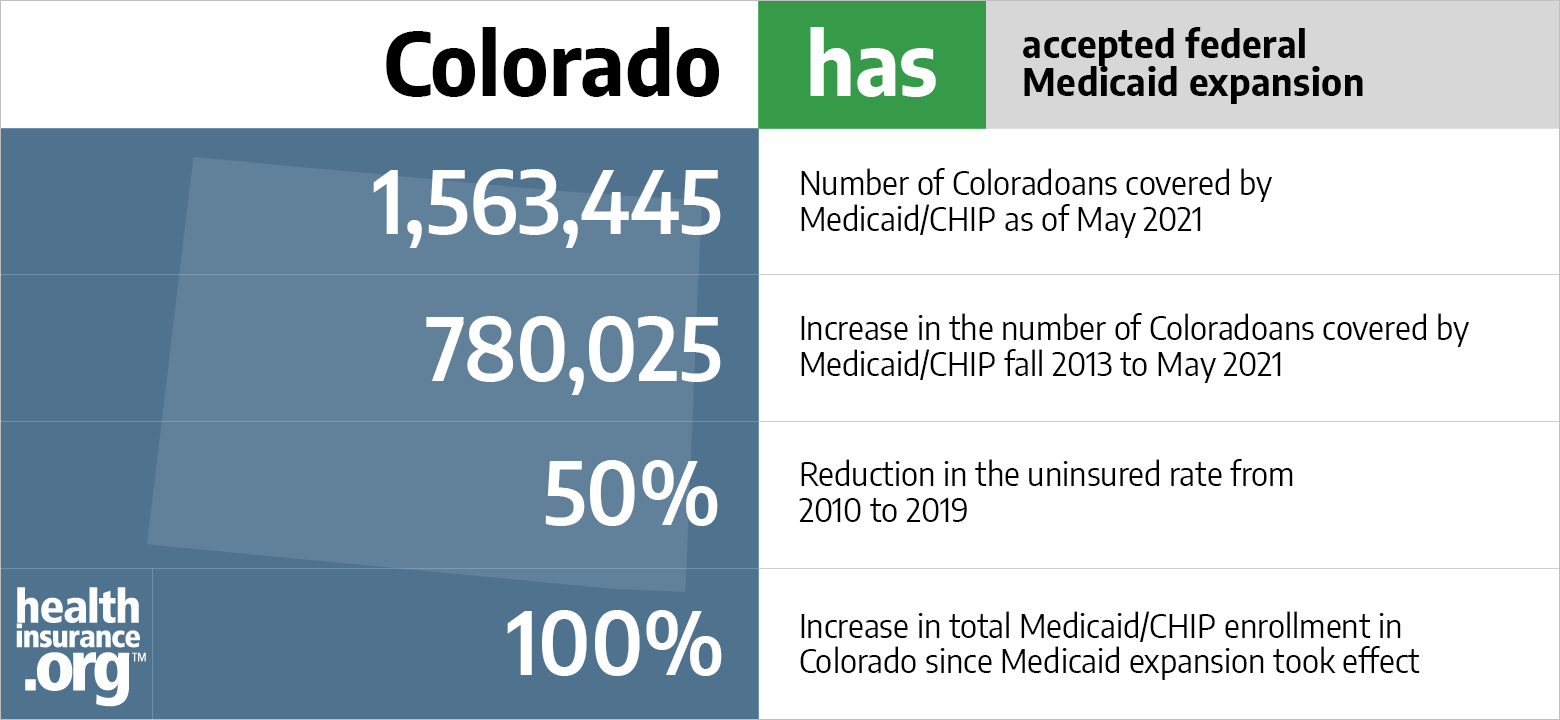

Aca Medicaid Expansion In Colorado Updated 2022 Guide Healthinsurance Org

Epub Free How To Get A Green Card Pdf Download Free Epub Mobi Ebooks Green Cards Cards Health Insurance Coverage

Auto Insurance Quotes North Kent Cournies Mi Buy Health Insurance Life Insurance Policy Compare Quotes

123 Reference Of Aaa Auto Insurance Louisiana Cheap Car Insurance Insurance Quotes Car Insurance Comparison

Should I Move Before Shtf Survival Mom Survival Survival Quotes

Healthcare Reform Infographic Healthcare Infographics Infographic Health Health Care Reform

Growing A Corn Crop Farm Facts Farm Agriculture Education

State Of Colorado Mini Cobra Law What You Need To Know

Surprise Medical Bills Colorado Consumer Health Initiative

Cih Exam Self Practice Review Questions For The Industrial Hygienist Examination 2014 Edition With 120 Quest Life And Health Insurance Exam Review Prep Book

Colorado Cobra Continuation Coverage Law Help

Colorado Cobra Continuation Coverage Law Help

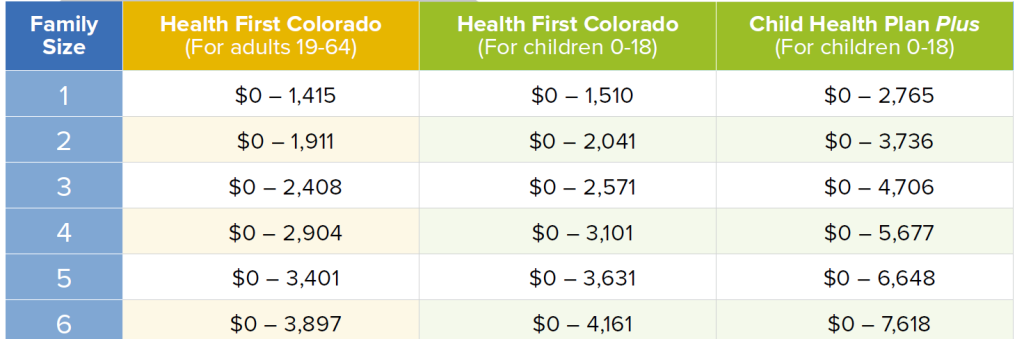

Are You Eligible For A Subsidy

State Of Colorado Mini Cobra Law What You Need To Know

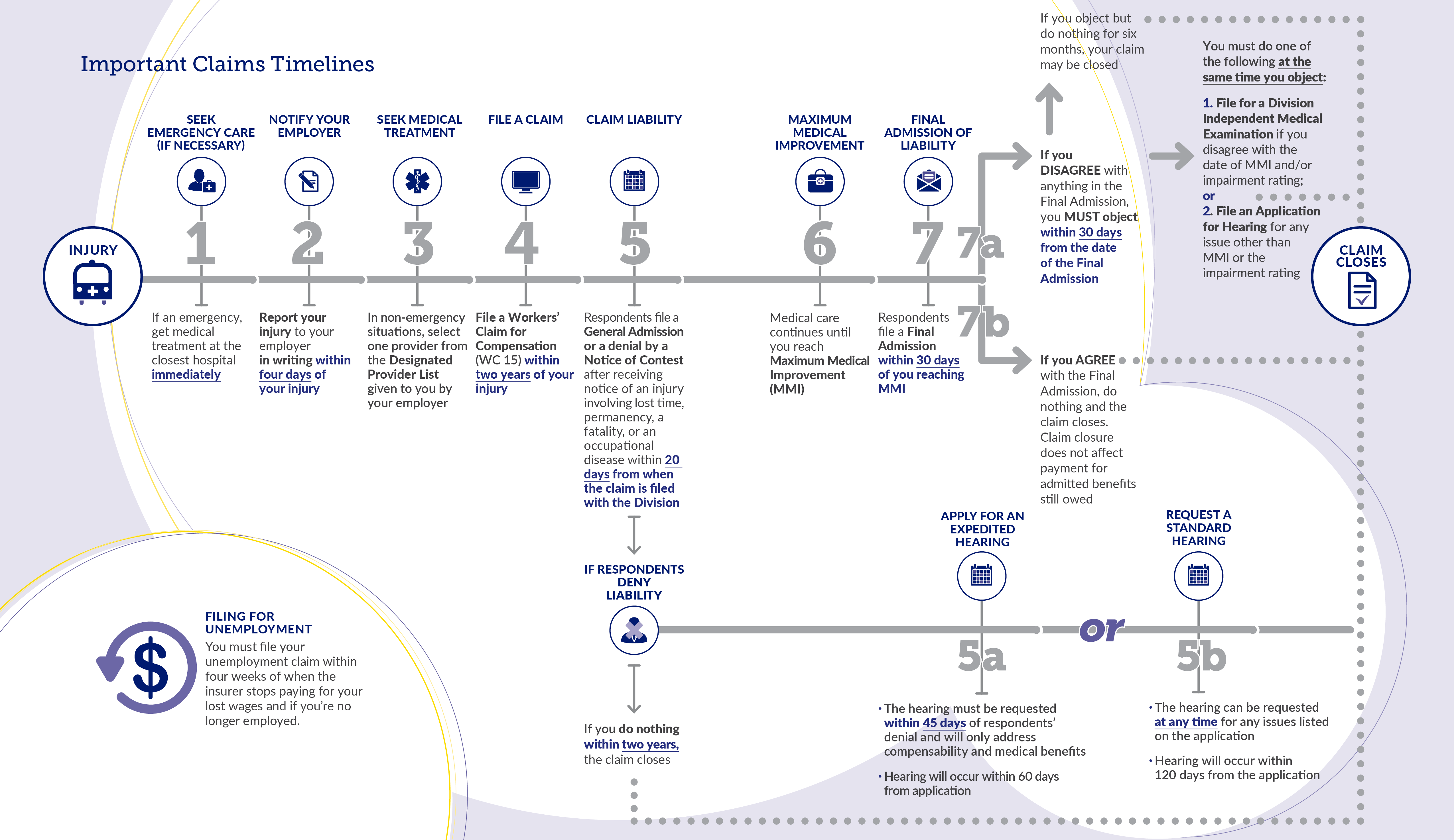

Employers Department Of Labor Employment

There Are Several Myths Surrounding Hipaa Regulations Here Are A Few Myths Debunked To Get A Cleare Health Information Management Medical Coder Medical Coding